Spend Assessment – Critical Step To Success Of Strategic Sourcing Initiative

Let’s say you’re committed to reducing costs whether it be direct materials or indirect materials and services. Where do you start? This article covers the essential steps for conducting a spend assessment which has a number of key challenges from “dirty data” to stakeholder alignment.

Step #1 – Data Collection

A good starting point is understanding exactly what you purchase currently, from whom do you buy it and at what cost; what is commonly referred to as a “spend cube”. This is easier said than done, especially if your company has multiple divisions, multiple systems etc. A typical starting point is collecting an Accounts Payable file or files covering one to two years of purchasing activity.

Step #2 – Data Cleansing & Normalization

The data first needs to be cleansed and normalized (IBM vs International Business Machines vs I.B.M.) before you begin to identify where the opportunities might be. This step is not to be taken lightly as it can be painstaking work. Hopefully you have a tool that can help with this, or you may utilize a third-party who has an intelligent tool (helps with categorization) and may choose to do the work somewhere where labor rates are not as expensive (e.g. India, Eastern Europe).

Step #3 – Data Mining

Once the spend cube is developed, then what? You need to search for potential opportunities. Look for evidence that spend is fragmented across a given category or categories of spend. If your company is buying laptops, whether with the same specifications or different, from five different suppliers, at different pricing levels, that would seem to indicate that the total spend should be leveraged across fewer suppliers or one supplier to obtain better pricing. If the spend is already leveraged with one supplier but that supplier hasn’t been challenged in twenty years, that could also be an indication that you could be paying too much. You get the idea. The point is that you must first develop a clear understanding of your spend and where the opportunities are.

Step #4 – Qualitative Analysis

Developing the understanding usually requires not only the data work outlined above but also interviews with key stakeholders. I was doing some work once for a supplier of CPG products and was interviewing a Logistics Manager whose last name was the same as the name of his #1 carrier. I kiddingly asked if there was any relation and he said “yes, he is my brother”. Obviously, this was a problem that I otherwise wouldn’t have uncovered had I not had that conversation. Interviewing key stakeholders serves a double purpose to not only help you understand what you are seeing in the data but also to gain agreement with the stakeholders that the given category should be sourced given the evidence uncovered in both the quantitative and qualitative portions of the assessment.

Step #5 – Category Prioritization

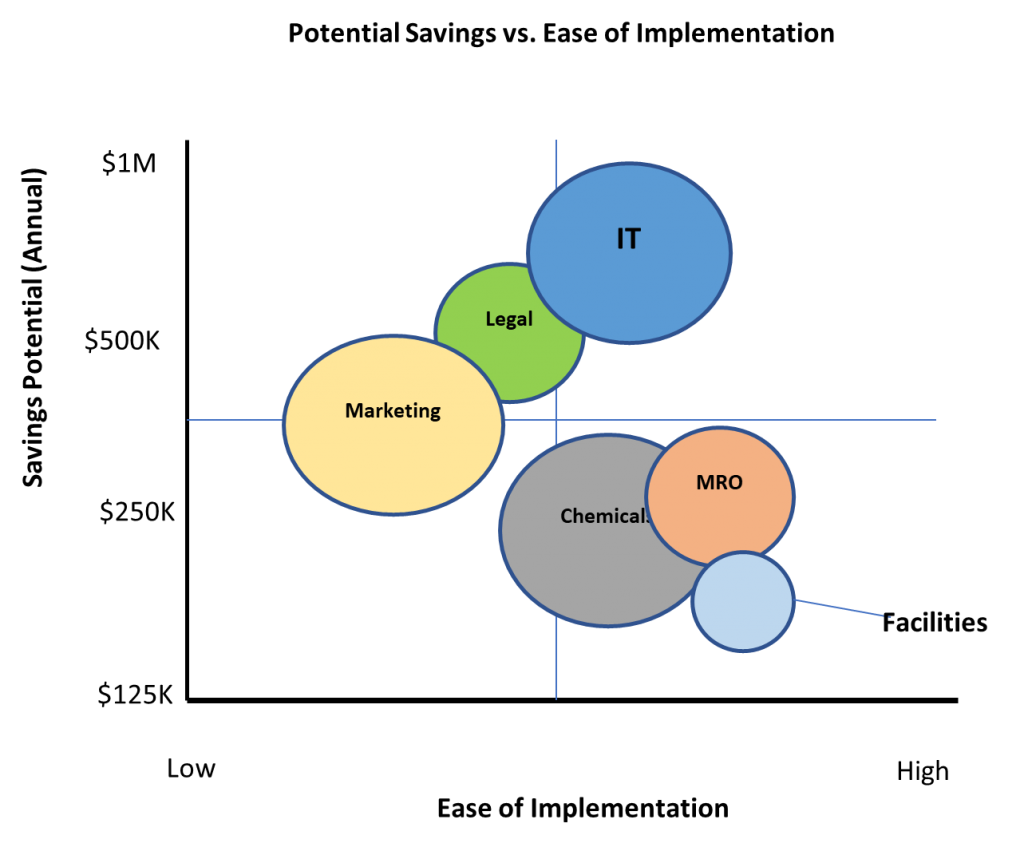

Having an understanding of total spend per category, along with potential savings should you decide to source that category (addressable spend and potential % savings), you are now in a position to prioritize the work. I always found it helpful to create a bubble chart where each category is plotted on a chart where the savings potential is on the “Y” axis and the ease of implementation on the “X” axis. The size of each category bubble reflects addressable spend. The resultant chart will display highest potential category bubbles in the upper right-hand corner (high savings potential and high ease of implementation). The chart is often called a “wave chart” to help determine which categories are appropriate to address in which waves; first, second and third.

Step #6 – Matching Talent with Categories for Sourcing

Finally, the question of who should do the sourcing work needs to be answered. If you don’t have the talent in-house or they are tied up doing other things, you may need to search outside for project related assistance which could be a consulting firm or a firm like OnDemand Resources who can provide the interim talent needed to complete the sourcing with you. Of note, OnDemand Resources is a WBENC certified women-owned company, which could also help you increase your diversity spend.

Whichever path you choose, the fact that you have methodically gone through a process to identify and prioritize sourcing categories will help focus your work and maximize savings capture.

If you are interested in more details spend assessment, please contact me at glong@ondemandresources.com to discuss how to best deliver significant value through setting up a successful strategic sourcing initiative.

ABOUT THE AUTHOR

Gary has siginicant Procurement & Supply Chain experience across both industry and management consulting. His industry experience includes Pepperidge Farm, Sealed Air Corporation and Teva Pharmaceuticals. His consulting experience includes senior positions with Kearney, Accenture, FTI and others. He has supported clients in the areas of Sourcing & Procurement, Supply Chain Strategy, Logistics and S&OP. He has successfully combined his hands-on experience in industry with leveraging leading practices gained from 20+ years of management consulting experience across a broad array of industries including but not limited to CPG, Diversified Industrials, and Pharmaceuticals.

Tom Donatelli Joins OnDemand To Enhance Our Client Service Capabilities And Broaden Our Market Reach