Tail Spend Focus Can Deliver Significant Savings

Ever since Peter Drucker made his famous statement about procurement being the last frontier of finding corporate efficiency in 1982, companies of all sizes have embarked on implementing procurement enhancements as a way to control and reduce cost. In nearly 50 years of procurement focus, one portion of vendor cost has gotten very little attention – Tail Spend, broadly speaking 20% of the overall spend that comes from 80% of vendors. While Tail Spend is something that always will be present in the cost structure of any organization, below are some examples where Tail Spend represents inefficiency:

- Using local vendors for services when there are existing agreements with national vendors, e.g. housekeeping services

- Using software services specifically for individual business functions when there are enterprise level services available, e.g. business intelligence

- Using services that are not required or are already provided by existing vendors, e.g. certifications, marketing research, project management

- Rogue spend, not approved under any budget

Because of the relatively small amount of spend associated with any individual vendor, Tail Spend can escape attention from finance and procurement functions for a long time.

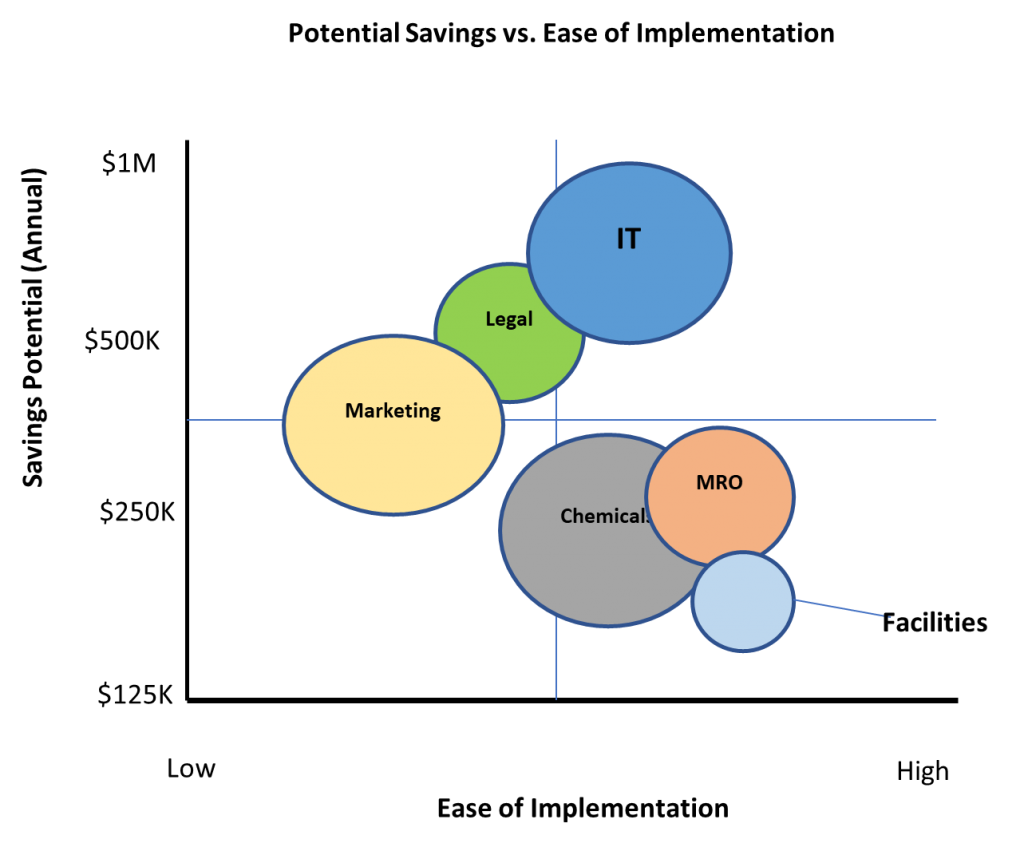

Paul Dhaliwal, a member of our OnDemand Professional Network has developed a systematic approach to identify suspect vendors within tail spend that may fit the criteria outlined above. This approach enables rapid identification of these vendors and take appropriate action in collaboration with individual spend owners. Typical disposition off these vendors includes immediate shut-off of their services, transition of their services to existing vendors, or consolidation with a national vendor. Tail Spend initiatives can yield cost reduction totaling 2% – 5% of overall total indirect cost and can be implemented quickly within 6-12 weeks depending on the size of an enterprise. Tail Spend represents one of the best opportunities for quick cost reduction initiatives in these times.

RECENT CASE – $4B FAST FASHION RETAILER

A national Fast Fashion Retailer had grown rapidly through both organic growth and acquisitions. They had already instituted procurement excellence on all major categories of indirect spend related to categories like facilities, marketing, logistics, professional services, HR, etc. The company decided to look for additional cost reduction opportunity in Tail Spend management. Over a 12-week engagement spend data related to ~5000 suppliers was reviewed, over 50 functional and other spend owners were interviewed, and over 12 workshops centered on specific functions like marketing were conducted. A two-pronged approach was used:

- Individual discussions and analysis of all vendors with spend greater than $25K. The goal was to identify select vendors who could be shut down or combined.

- Direct communication with spend owners of a large number of vendors with spend less than $25K annually, here all vendors were presumed to be shut off unless the spend owners could provide a written justification on why their services or products needed to be continued.

Overall the initiative resulted in net annualized cost reduction of $18M, 4.5% of total $400M indirect spend.

GUIDELINES FOR EFFECTIVE TAIL SPEND INITIATIVES

- Focus only on indirect cost, exclude any vendors with direct revenue impact, this minimizes the risk

- Exclude items like taxes, other government payments, rent, benefits

- Exclude spend related to large projects which have defined budgets and timelines

- Analyze 2 – 3 years of spend data at minimum to establish trends

- Top down executive mandate or push to reduce tail spend is very helpful in communicating goals to individual spend owners

- Budgets need to be reduced after any vendor shut-offs are agreed to, otherwise savings realization cannot be tracked

MEET PAUL DHALIWAL

OnDemand Professional Network Member Since 2018

Seasoned executive with 24 years of experience in delivering bottom-line results for clients by reducing operating costs, reorganizing core business functions like Finance & IT, improving asset utilization, and reducing working capital requirements. Ability to work and deliver results in range of company sizes ($200M – $5B+), situations (enterprise improvement, PMI, distress, carve outs), and roles (exec leader, advisor, hands on implementer). Paul has BS in Mechanical Engineering from University of Illinois and MBA from MIT Sloan School.

Tom Donatelli Joins OnDemand To Enhance Our Client Service Capabilities And Broaden Our Market Reach