Procurement Approach To Sole-Source Vendor In Monopolistic Market

One of the largest biotechnology companies in the world needed to quickly develop a strategic supply agreement with a sole-source supplier before impending contract expiration. With no existing category manager or in-house expertise, and little time for execution, they were looking for a specialist who could identify opportunities for value, develop the sourcing strategy, and help them implement a long-term supply agreement that would lock in the value. They turned to OnDemand Professional Network member Art Brunton.

CHALLENGE

The sole-source nature of secondary data made it nearly impossible for the client to avoid significant annual price increases. They also had little control over the assurance of supply, quality and service of the data. In addition, all of the industry competitors procured the same data sets, so the competition for the supplier’s performance was extraordinary.

- Proprietary data types – the supplier was sole-source because they owned data technology and supply sources that no other supplier could offer or penetrate. For nearly 30 years, the main barriers to entry for additional suppliers were technology, cost of entry, and access to data sources. There was no potential alternative to the supplier on the horizon either.

- Data set obsolescence and rationalization – the client did not have a grasp on the data sets they were purchasing on a regular basis versus what was actually needed. Therefore, potential obsolescence and rationalization were not clear.

- Fragmentation in spend across the client’s organization – the client had numerous groups within its US organization buying other products and services from the supplier. It also had many other business partners globally buying the same secondary data sets. However, consolidation of spend was not occurring anywhere, and the supplier was leveraging the fragmentation model as a result.

APPROACH

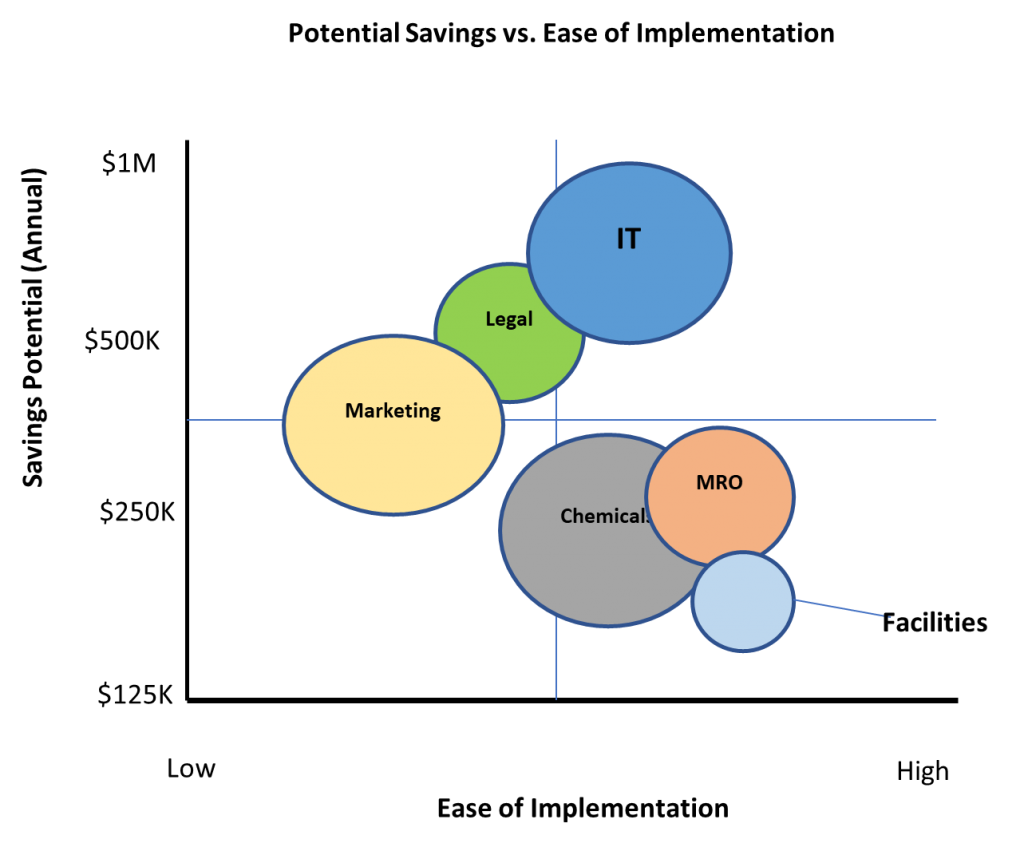

An opportunity analysis, including current business requirements identification, was conducted to provide an accurate business foundation for sourcing strategy development.

- Spend analysis and business requirements development – A cross-functional team was immediately formed to conduct and validate the spend analysis, and determine true business requirements. The focus was not only on cost, as the team spent significant time identifying its quality, supply, and service needs. These were then reflected in the supply agreement as additional clauses that assured compliance by the supplier. The team included members from Global Strategic Sourcing, Procurement Operations, Marketing Operations, Finance, R&D, and Legal.

- Data set rationalization – the team identified data sets that were no longer needed, and removed these from the scope of the project. This simplified the overall data set population for negotiations purposes, and created immediate quick wins cost savings for the client.

- Inclusion of other global business partners – the business partners from Europe, Asia, Canada and Puerto Rico buying the same data sets were included in the negotiations. Even though the supplier did not have a functioning global business model in place, they agreed to honor the US pricing (which was superior to any other region) in exchange for the US contract to be adhered to by the business partners. This resulted in significant savings to the business partners and price control through the duration of the contract.

- Sole-source negotiations strategy – a high-spend category that was effectively sole-sourced with minimal leverage required a comprehensive negotiations strategy. The team engaged three global subject matter experts in both secondary data and the supplier to gain market intelligence and supplier-specific knowledge. This provided valuable information and leverage points for the negotiations plan. Risk mitigation and value-add clauses for the business requirements relating to quality, supply and service were developed with Legal. The negotiations were patiently conducted in a face-to-face environment with multiple iterations which resulted in maximum value for the client over the four year contract duration.

RESULTS

- Strategic sourcing savings and cost avoidance – 11%

- Data set rationalization leading to greater savings

- Opened up US-pricing to the rest of the client’s global partners resulting in higher savings for the global client and reduced risk of price inflation over the life of the contract

- Long-term supply agreement – 4 years

- Significant risk mitigation due to new supply, quality and service clauses included in the contract that protected the client’s data interests

MEET ART BRUNTON

OnDemand Professional Network Member Since 2017

Art has been creating significant financial and non-financial value for clients through procurement, supply chain and operations strategy for 22 years via leadership and interim management roles. He possesses a background across many industries including pharmaceutical and bio-technology, healthcare, medical devices, food and beverage, telecommunications, hospitality, financial services, metals and mining, among others. As a strategy development and supply chain improvement expert, Art is also proficient at bridging the gaps between the Operations and Commercial groups at his clients. Art earned an MBA from Rensselaer Polytechnic University and a BS in Industrial Engineering from West Virginia University.